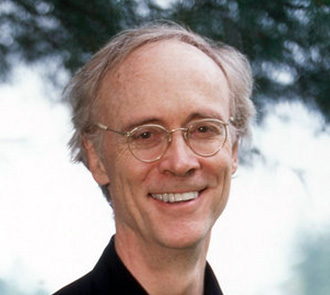

What stands in the way of pursuing the life you truly want? This can seem like an overwhelming question, but by unlocking a few powerful secrets, your dreams can become achievable. No one has done more to reveal these secrets than our guest on this podcast, George Kinder. A Harvard-educated CERTIFIED FINANCIAL PLANNER™, George is internationally recognized as the father of the life planning movement. He’s an author, thought-leader, and founder of the Kinder Institute of Life Planning. Through his best-selling books/audiobooks, workshops, and speaking engagements, George has trained thousands of financial professionals all over the world to empower their clients with his groundbreaking methodology.

Join us as we discuss how the life planning process works to elicit your true goals and helps support you all the way to achieving them. Learn how you can discover what you really want to accomplish—and take the right actions to create the meaningful life you wish to lead.

Subscribe to our podcast on Spotify, Apple Podcasts, Google Podcasts, and Stitcher.

Click to read transcript of this episode below.

Episode Transcript

Announcer 0:02

Welcome to the Biz Money Podcast hosted by Lee Korn. Lee is a financial advisor and principal at Opal Wealth Advisors. Each month Lee and his guests share their path of success and how they broke through to get to the next level. This podcast is available on our website at opalwealthadvisors.com/bizmoney. To receive updates on new show releases, you can subscribe on our podcast page. Now, here’s your host, Lee Korn.

Lee Korn 0:29

Welcome to the Biz Money Podcast. I’m your host Lee Korn. On behalf of my colleagues here at Opal Wealth Advisors, we’re excited that you’re able to join us.

George Kinder 0:43

One of the things that wasn’t happening was real listening to the client and really putting the client first in terms of understanding who they are, what their aspirations were, their fears were and, and making sure that the money served the clients purposes.

Lee Korn 1:01

Our guest today is George Kinder, founder of the Kinder Institute of Life Planning. George is internationally recognized as the father of the life planning movement. Over the past 35 years, George has trained more than 4,000 professionals globally in this field, myself included. His three books on money, which include The Seven Stages of Money Maturity, Lighting the Torch, and Life Planning for You, are considered seminal works in the field of financial life planning. George, welcome and thanks for joining us.

George Kinder 1:30

Glad to be here. Really nice to see you again.

Lee Korn 1:32

So George, we had you in our office, we were just talking over four years ago, pre-Covid. And it is so great to see you again. We got to see you with a live audience 30 or 40 of our clients. And I can tell you, we’ve had lots of speakers and lots of guests in the office, and you still are rated as the best speaker. So I am very happy that we can do this again.

George Kinder 1:55

It was I will say it was a highlight of my year really being with you guys, because it was so much fun. Your community, your clients were among the greatest group that I’ve been with. So a lot of fun. Really,

Lee Korn 2:08

I appreciate that. So George, financial planning, most people have heard of it know what it is. But financial life planning not so much. Maybe you could start by explaining what financial life planning is.

George Kinder 2:21

Sometimes it’s called life planning, sometimes financial life planning. The I think of it in two different ways. And I’ve heard it described by others in two different ways. One is that it’s what needs to happen in the advisor’s relationship with a client before the financial planning begins. That’s one way. And the other way is it’s the whole thing. It’s the whole process from learning who the client is, which is a lot, but that initial process is to delivering the financial plan at the end.

Lee Korn 3:00

It’s great. So financial planning has been a modality for many years. Why did you see the need to take this type of approach? And what’s the story behind it?

George Kinder 3:13

Well, I mean, I go back even further than you read in the industry. And back when I when I started, it was all brokers. That’s all it was. And, and shortly after that, there began to be a movement of financial planning, which was very exciting to see. And so we saw the development, the move from commissions, and the other thing was the move from commissions to fees. So there are none were things that were changing this was in the early 80s. But one of the things that wasn’t happening was real listening to the client and really putting the client first in terms of understanding who they are, what their aspirations were, what their fears were, and, and making sure that the money serve the clients’ purposes. So that’s one of the cool things that life planning does. A lot of times advisors will ask you, you know, what do you want from me. But consumers are so much driven by the news just as we are. So they’ve been reading about what advisors do. And, and so they, they will list those things. What’s really cool about life planning is we seek to really deliver the clients into the life of their dreams into who they really want to be. And this is for people rich and poor. You know, all the differences that are out there, young and old. It’s a great thing,

Lee Korn 4:35

Right. We’ve worked with so many clients, and when they come in, and you ask them about their goals, it goes to the traditional societal retire at 65, live off of 80% of my income, it’s almost pre-conditioned, you know, people just don’t even know they’ve read about it. They never really thought about what is it that that I really want? More importantly, it’s, I guess what I’ve seen is to make things happen, there needs to be action. And sometimes there’s a world that lives between knowing and doing, I always say, if you want to lose weight, you could Google it and find a million different answers. But why is it that people don’t lose weight? Or why is it that people don’t take the action, lower your cholesterol, because there’s action and in order for action to happen, there needs to be motivation. And I have certainly found that using this process, it has helped us get to the real meat of what really motivates people and what they’re on this earth for and what they really want to do. So maybe I could continue and talk about the process. So, you know, the, I guess, the cornerstone of the process where we start, you know, the three questions. So maybe you could just talk about the three questions and how you came up with those three questions like, where did that come from?

George Kinder 5:49

Lee, you know this process so well, it’s wonderful listening to you speak about it. The key here is what motivates what inspires what the client really wants. And so the process begins even before the three questions, in a you could call it active listening, but a lot of it’s really quite passive. It’s just listening, really listening, and listening in a way to the client where they can feel your responsiveness to both the challenges that they’ve had in their life, or that they do have in their life, and the things that they just love to do. And so we you know, we celebrate the things they love to do. And we show that we care about the things that are challenging. So when the next phase of the meeting comes up, which is where these three questions arise, the client is actually eager to talk with you, they’re eager to have a methodology. So one of the things I mean, there are a number of things, but the one that probably I’m most famous for is these things called the three questions. And we start with an easy one. One that anyone would probably answer, because we’re really warming the client up to go to what is profound for them, what has the greatest level of meaning for them? So we start with, Hey, if you had as much money as used to be the queen of England, now, what are we going to say JK Rowling? You know, Elon Musk, if you have…

Lee Korn 7:26

Michael Jordan, I just watched the movie Air, we could say Michael Jordan.

George Kinder 7:30

Let’s say, as Michael Jordan, you know, what would you do, well, maybe you don’t have as much money as that, but you’ve got all the money that you need for the rest of your life. So that’s an important qualification of the question because all the money that you need for your life is going to be different for someone who’s lived more in in lower income than someone who’s kind of sailed with the finest yachts in the world. So what would you do if you had all the money you needed? And people talk about it’s like winning the lottery, it’s fun, you know, you think about what those extra things what the trips will be, you know who you’ll see what your house will be like, you know, all those things. Great.

Lee Korn 8:25

Awesome. So, you know, we’ve, I feel like I’ve gone through those questions so many times. I guess it was profound when I did it myself. Right. They always say yeah, if you’re going to do it on someone, you should be willing like to do it on yourself and Laura from your organization, we were just talking about that she was my coach. And, and it was an interesting experience, you know, what I thought I wanted wasn’t actually what we boiled it down to. But the next step, you know, you talk about vision, right painting a vision, because in order in order to take action, I always say you need a strong vision, you need something pulling you towards that, or someone really strong pushing you from behind, which sometimes we do both of those things. Talk to me about the torch statement.

George Kinder 9:12

The torch statement really comes out of, mostly out of the final two questions. And so the second question is, if you only had five to 10 years left to live, what would you do? And the third question is you go to the doctor, and he shocks you with the knowledge that, in fact, he’s messed up and you only have 24 hours left to live. You had no idea about that before. So you reflect on what you had anticipated, doing what you really longed to do. And that’s the most profound and the deepest question. And it’s out of that question primarily leaves, you know, that the torch comes. So what we do with that, is we build kind of the most profound, the deepest, the most passionate elements that our clients have the three questions into what we call a torch statement, where we say, hey, you know, if, as a consequence of our work together, I or we could deliver to you this, this life, how would that be? I’ve never had a single person turned me down. Because what we do is we deliver them into the life that they most long to live in. So no longer they’re going to be driven by habit and, and conformity or whatever else what the world says that they should do. They’re going to be pursuing who they really want to be. It’s pretty incredible.

Lee Korn 10:48

It really is. George, you might not know this, but our whole process, right, we have a process called the Opal Way. It’s got seven components to it. And it starts with financial life planning. And you know, those questions and the torch and the vision statement, it is an integral part of it. You almost can’t not build a financial plan without knowing what someone really wants to accomplish, and then get them aligned to take those actions.

George Kinder 11:17

Yeah, how could you? I mean, yeah, you know, they do it all the time out there. People who call themselves financial advisors do it all the time. And they’re clearly really not, they’re not certainly fiduciary advisors, they’re not putting the client first, right? Absolutely.

Lee Korn 11:36

So true. So now, you know, we’ve elicited the true goals, what really moves someone what they want, we’ve painted the vision, we’ve put them in the future, and gotten them comfortable sitting there. And now it’s time to take action. Right. And then the next part of the process, we talk about obstacles. I don’t know if it was Ed Jacobson, rest in peace, he was an amazing teacher and trainer. Yeah. The one thing I take away from that he always used to say Be the Buddha, not the Buddhist, right? Just be, live, live it. And add also said that the coach or the planner, I’m sorry, the client should do more work than the coach or the planner. And that’s like obstacles really someone sitting in? Okay, so you’ve painted this great vision, but what could go wrong? What are the things that could make this not happen? And then what could you do? Maybe talk a little bit about that?

George Kinder 12:33

Yeah. Wonderful. What Ed’s saying, there’s one of the sayings that we use in life planning all the time, if the client’s doing more work than you then there’s something wrong. I mean, I mean, if you’re doing work for the client, you know, exhausting yourself in some way, that’s not the right way. So that we really, by the time we get to the obstacles meeting, is typically the third meeting. You can shorten these meetings. And so it could happen in the second meeting, or even in the first but typically they go in sequence and it’s the third meeting. And when you get to the obstacles meeting, the client is so engaged around making their life work. They’re astounded that you support them in doing what they’ve always wanted to do many times the goals that they have are goals. I mean, as you said, they weren’t goals that you really recognized at first, or maybe you knew them deep inside, but you didn’t realize they were the ones that you spoke to. Often their goals that weren’t, aren’t spoken to their spouse, to their best friends, they’re profound. And when the client feels that they’re actually going to get those, and that’s the obstacles meeting starts out with giving them the torch again. And then saying what could possibly get in the way, you know you were meant for this life, what could possibly get in the way, what you discover as an advisor is often the prior two weeks, the client has been racing through other obstacles and making it happen already. So a lot of the obstacles have disappeared already. And they’re gonna tell you all about that. And then they’re going to move on with what they think might remain or what their game plan is. And our job becomes really listening and supporting and occasionally asking them questions such as, What’s the timeframe? When are you going to do this? How are you going to do it? You know, just moving, just getting a little detail into the obstacle frame, but mostly, it’s just really supporting them. And, and then the next meeting, of course, is the financial planning meeting.

Lee Korn 14:47

Right, moving it from the abstract or the thought to something real by putting a little bit of accountability in there.

George Kinder 14:53

Lee, and that’s what it is. You know what, that’s what inspiration does for you. If you’re inspired about something, you’re gonna make it happen.

Lee Korn 15:04

Yeah, yeah, there’s got to be motivation. So beyond finances, right, so it’s life planning, financial life planning, I call it financial life planning, because that’s the world we’re in. But how can someone use this in their daily lives, you know, put aside finances, beyond finances, to reach their highest aspirations to create more meaning, more purpose?

George Kinder 15:25

I’ve worked with these questions for gosh, certainly over 30 years, maybe 40 years. And I’ve made a practice in my own life, to revisit them several times a year, I don’t have a particular program for that I don’t have a date that I’m going to do it. You know, sometimes, it’s something sweet, you know, that life is throwing you a blow that you weren’t expecting, and you feel like you want to revisit what your life’s about what’s meaningful for you, that’ll be a time I do it. Or like, I’m in a workshop with you guys. And, and everybody else is doing it, I haven’t done this in a while I might as well do it. And so I just pick up, pull out a pen, and a piece of paper and do it. And as a consequence of that I’ve I personally have lived a life not only as a financial advisor, and as a trainer of financial advisors, but I live a very active life out in the world. I’m very concerned about civilization. I’ve written a whole bunch of books, I’ve written books of poetry and photography, books of meditation, books on civilization. And all of this happens, because I keep going back to that well of inspiration. And discovering, you know, who is it that I want to be? One of the things that changed, two things really changed for me during that during all these years. One of them was out of the blue, the city of London, came into my third question, always before that’s been the same answer. And suddenly, I was launched, I was spending three months here in London. And I think the other thing that changed that was quite wonderful. I’d never really imagined having kids. And I had two just incredible daughters who are now 20 years old and heading off to college. And it’s just been an amazing life to live with them. And so many different aspirations came up as a consequence of that. So we just put these things in front of you and your life will feel very rich.

Lee Korn 17:32

Yeah, I can attest I, my daughter just finished her first year of college. So I brought her home but for some reason, I don’t know. She wanted more pain, she decided to take two summer classes in physics nonetheless. So yeah, go figure. But I mean, on a personal note, much of the stuff that I’ve accomplished over the last five years stemmed from those three questions and the answers, some of them took a little longer, right, it was getting healthy and losing weight and, and relationships with family relationships with my kids, starting this business, you know, my partners and I started the business. A big part of it was to be able to deliver this type of work to our clients, into our friends into our family. So it’s, it’s been really, really meaningful. Taking a different, a different tack for a second, maybe. So I’ve heard this story about how you got started. And like your background, it’s pretty phenomenal. Maybe you could just tell our audience, our listeners, like your background, how you got started, how you decided like where you started in traditional finance and how you made that transformation.

George Kinder 18:40

Yeah, I’d be glad to. I don’t know where which part of the story you picked up, but I’m gonna start back in pretty soon after college, I was passionate about I knew who I wanted to be even then. I knew that I wanted to be an artist, a poet, and I wanted to have a spiritual life. So I became a financial advisor, right? I mean, that’s the funny thing was I, you know, I had no money, what am I going to do? I had graduated from Harvard. So I had the brainpower and all this, but I didn’t have resources. So I started doing taxes for a living thinking…

Lee Korn 19:22

Various marginal taxes. Yeah.

George Kinder 19:25

I can do that. But I can do them three or four months of the year, right? So and then I could take the rest of the year and do what I really love. Well, you know the rest Lee, I was good at it. So before I knew it, I didn’t have this firm, maybe quite as big as yours. But I was gathering people into the firm. And we had lots of clients all over the place, and all over the world, really. And so I but I always kept a space for that other, that other world. And what I began to see was clients come in to see me, people would ask me, and they say, why don’t you do financial advice? And I go, No, no, that’s not me. And then I’d see people come in as clients, and they would have invested in the dumbest things, things with huge commissions. These were back in the days, I think, well before your beginning. But back in the days that limited partnerships could have as much as 30% upfront fee, and the client, not be aware of any of it. And I got ticked off, basically. And so I just said that nobody’s gonna do that to my clients. So I got a degree in financial planning, I became a certified financial planner. And as I did it, I realized that the other thing that I realized was that all these clients that came in to see me, they all were kind of growing gray hair, like I have, and they all wanted to do something other than what they were doing. So many of them had passions that weren’t being realized. And just by getting to know them, I could see that. And so right on the get-go, right. As I started my financial planning practice, I started to work with these questions and other exercises that are also in the life planning community, to feed to the clients an opportunity to live their aspiration. And I was determined then to make that the centerpiece of what my financial planning firm would be. So I was a financial advisor for many years, and starting with taxes, but always I put the clients first. I was always doing that.

Lee Korn 21:36

Yeah, one man’s, one person, small inspiration as it grows and grows and grows. Reminds me of this story totally. nonrelated reminds me of the story of Memorial Day, most people don’t know how Memorial Day got started, there was a pharmacist in upstate Waterbury who wanted to do something for the returning soldiers, or the soldiers who had perished in the Civil War and wars. So he put a yellow ribbon around a tree. And he did it all in his own community. And then the following year, he got the community that was next to there, and then on and on and on, it grew and grew and grew and grew, you know, only did it become a national holiday, you know, in the 20th century, but one person’s small movement, how it’s just grown and grown. I view yourself like that. Your movement in financial life planning has had many ripple effects on myself personally, on clients, on many people. So I thank you again. Thank you. While I have you here, I’d love to ask you about I don’t know if it’s your newest book, you talked about it, The Golden Civilization. You know, you talked about it four years ago, when you’re up here in the office, maybe just give the audience a little teaser.

George Kinder 22:50

Yeah, I’m gonna give a teaser on two books. Golden Civilization takes you to the book that I’m just completing, which is a series of five books of poetry and photography, intermingled. And it’s about living. Like living like Thoreau. It’s living on this pond that I live on, but living moment by moment, and you can it’s there’s a free subscription so that you can get it in your in your email every week, with me reading it as well. So I’m very pleased with that. That’s really I think of as my legacy. But I’m passionate about civilization. I’m starting a new book on this way that you and I can talk about at some point, but that the Golden Civilization was the theme. I mean it flies in the face of all that we’re seeing out there. We’re seeing so much polarization, so much trouble. So much we can’t speak to each other. And I have this notion that why, why? Why is it? Why not? Why don’t we have everything that we need to make a golden civilization to make a civilization that really works? Certainly in America, and why not all over the world? So I crafted a vision of that. And I integrated its subtitle is and the Map of Mindfulness. So that also has to do with, you know, having some spiritual element to it are so does not necessary but very, very helpful. And what I did, I went on a world tour, and you guys were part of that that was really cool in your office. And of course, I’m sure that you had people from all different political segments can’t come into the office. And we just had a conversation about what would be an inspiring civilization, for America or for the world debate. I went to Hong Kong, when they were carrying the umbrellas. And I went down, I was so passionate about it, I was giving a workshop, a financial workshop. And I saw these kids through the window of the hotel that I was in, and I said, pardon me, I’ve got to go down and speak to them. So I left the workshop, and went down to talk to them. I mean, we all know of course, what’s happened, and we’re at the anniversary of Tiananmen Square, which is a very sad thing. But I’m convinced that it’s time for us to deliver a golden civilization. What I found all over the world was people wanted the same thing. Not this polarization that we’re seeing, that seems to be driven by media and by powerful forces. People wanted kindness. They wanted competitiveness. They wanted caring communities. They wanted opportunities. They wanted no racism, they didn’t want bigotry. They didn’t want corruption. They wanted peace. All of us all over the world want the same thing? Why don’t we deliver it? That’s my thesis. It’s called The Golden Civilization and the Map of Mindfulness. Thanks for asking.

Lee Korn 25:53

I love it. I think we’re all yearning for that, whether it be outwardly or secretly. And I think it’s been, it’s never been more timely to have that conversation. So thank you for your work on that. Well, George, this has been awesome. Thank you very much for taking the time. I really, really enjoyed it. I think now when when clients that are working with us, they start to go through our process. They’re gonna go, ah Kinder, I know where that comes from. I know the godfather. I know where you took that from. So we give credit where credit is due. And hopefully we can do this again soon.

George Kinder 26:30

Wonderful. Thank you Lee.

Lee Korn 26:34

Thanks, and have a wonderful, wonderful day. And thank you for listening. If you have any questions about financial life planning, and how it might help you achieve a more fulfilling retirement, call me at 516-388-7980 or drop me a note at lee.korn@opalwealthadvisors.com. I’d love to hear your comments and answer any questions you might have. I also encourage you to subscribe to our podcast by visiting opalwealthadvisors.com/bizmoney. That way, you’ll be the first to know what’s coming up in our series. Thanks again for joining us, and we’ll see you next time on Biz Money.