Join us and listen to the Biz Money Podcast, a series of engaging discussions featuring leading entrepreneurs, business owners, and the industry’s foremost financial advisors. Our esteemed guests share their insights into what you need to know to get on the right financial path—from managing cash flow, financial planning, and succession planning to establishing vision, values, and more.

Listen and learn. Our guests’ inspiring stories and advice can help you achieve your business and personal goals and enjoy the life you’ve always wanted. In each episode, we go beneath the surface and delve into our expert guest’s perspectives and experiences. We reveal the professional and personal challenges they faced on their way to success. At the end of each episode, you’ll walk away with actionable lessons that you apply to take control of your finances and help grow your wealth.

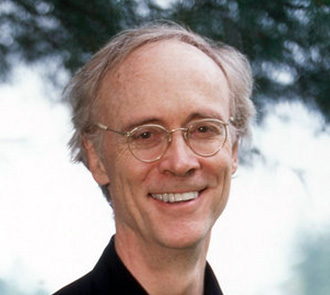

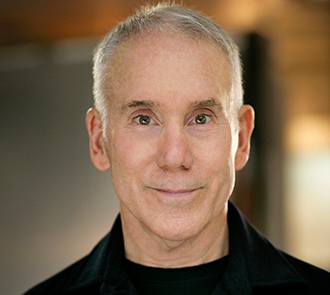

The Biz Money podcast is hosted by Lee Korn, principal and financial advisor at Opal Wealth Advisors. A recognized industry leader, in 2009 Lee was named by Barron’s as one of the top 1000 U.S. Financial Advisors. He is a strategic partner to his clients, helping them realize their goals by identifying opportunities and strategies to take their companies to the next level.