Take Advantage of the Sweet Spot for Roth IRA Conversions

By Matthew P. Krouse, CFP®, AAMS® | May 25, 2023Roth IRAs have been around for more than 20 years now. Which is long enough, it would seem, for retirement savers to have heard about the tax benefits they offer.

Yet, many Americans still aren’t using a Roth account to help build their nest egg and diversify their tax burden—especially older workers. Instead, they’ve continued to stockpile their money in traditional IRAs, 401(k)s and similar plans, deferring the taxes on their contributions and investment growth for decades.

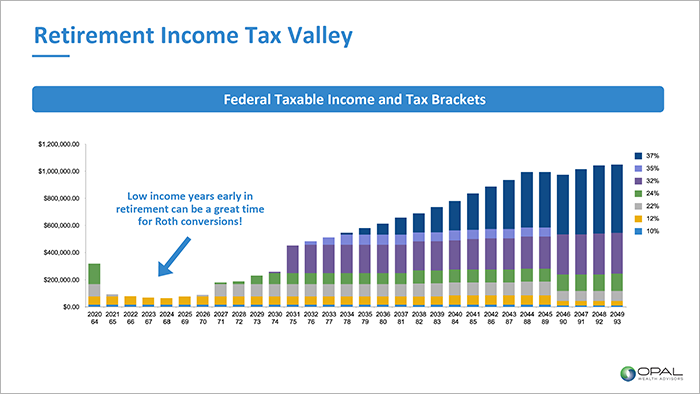

Now, many of those diligent savers are facing daunting tax bills as they settle up with Uncle Sam in retirement. The good news is there still may be time to rescue your retirement plan from this ticking tax time bomb. The period between when you retire in your mid-60s and when you turn 73, which we call an “income tax valley,” can provide a prime opportunity to convert funds in a pre-tax account to an after-tax Roth IRA.

Making the Most of the ‘Income Tax Valley’

Why this window in time in particular? When you do a Roth conversion, the money you move out of your traditional IRA or 401(k) and into a Roth is taxed as ordinary income. Combined with the income you’re earning while working, the conversion could bump you into a much higher tax bracket. You might even decide the cost isn’t worth the benefits.

But during those few years after you stop working full-time and before the IRS says you must begin taking required minimum distributions (which now start at 73), you should have more control over your income and, therefore, your tax bracket. You also may choose to delay claiming your Social Security benefits until you turn 70, to further lower your income during those first years in retirement.

By taking advantage of this “income tax valley,” you can minimize the cost of a conversion and enjoy the perks of owning a Roth IRA.

What Are the Benefits of a Roth IRA?

The most obvious difference between a traditional IRA and a Roth is how each account deals with taxes. With a Roth, you take care of the tax tab on the front end. When you make withdrawals in retirement, you owe nothing on your contributions. And, perhaps even more significantly, any money you’ve made on your investments also can be withdrawn tax-free.

Reducing the amount of taxable income you’ll have to deal with in retirement can have a tremendous benefit. By converting a chunk of your savings to a Roth you can:

- Lower (or eliminate) required minimum distributions (RMDs): Unlike a tax-deferred retirement plan, a Roth is RMD-free. Original account holders can keep all their money in their Roth for as long as they like, which means their investments can continue to grow tax-free. And you won’t be forced to sell investments at a loss when the market is down.

- Lower (or eliminate) taxation of your Social Security benefits: If your combined income in retirement (your adjusted gross income + nontaxable interest + half your Social Security benefits) goes over a certain threshold, you could end up paying taxes on up to 85% of your Social Security benefits. But because Roth IRA distributions aren’t considered taxable income, they won’t increase your combined income the way distributions from a traditional IRA or 401(k) would. The same is true when it comes to your Medicare benefits: By keeping your taxable income lower, your Roth can help you avoid paying the Income Related Adjustment Amount (IRMAA) surcharge on top of your Medicare premiums.

- Reduce your capital gains tax rate: Long-term capital gains tax rates are set at 0%, 15%, or 20%, depending on your income level. Because Roth distributions aren’t taxed, you may be able to receive a more favorable rate when you sell an asset.

- Keep taxes lower for your heirs: Unlike money left in a traditional 401(k) or similar account, contributions from an inherited Roth IRA can be withdrawn tax-free at any time. And as long as the account was open for at least five years when the account holder died, earnings from the inherited Roth also can be withdrawn tax-free. This could eliminate the heavy tax burden that’s often waiting for beneficiaries who inherit tax-deferred accounts during their highest-earning years.

Of course, it can be tricky to do a Roth conversion in early retirement without triggering the same tax traps that you’re trying to avoid later on—the Medicare surcharge, for example, if you’re 65 or older, or taxes on a larger portion of your Social Security income. The goal is to “fill up” the lowest, most comfortable tax bracket possible with the amount you convert each year, without spilling over into a higher bracket that would make the conversion inefficient and expensive.

How Can a Roth IRA Affect Your Withdrawal Strategy?

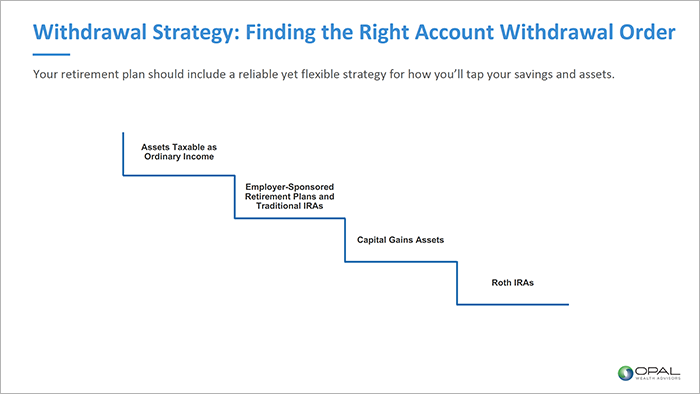

A Roth IRA can add diversity and tax-efficiency to your retirement withdrawal strategy.

If you start by tapping the assets in your non-retirement accounts, you can allow the money in your pre-tax accounts to continue to compound while you slowly convert some of those funds to a Roth. Then by the time RMDs kick in, your pre-tax accounts will have been whittled down—and a significant portion of your funds can be growing tax-free, for as long as you live, in your Roth.

Converting to a Roth IRA can shield your nest egg from future tax increases and the ticking tax time bomb you may be facing if you’ve overstuffed your tax-deferred account. But the conversion process can be complicated—and it’s not for everyone.

So it’s a good idea to consult with an experienced financial advisor before deciding if, when and how you should get started. Schedule a call with us today to evaluate where you stand and if a Roth conversion makes sense for you. Whether you’re a long way from leaving the workforce or ready to retire soon, Opal Wealth Advisors can provide personalized guidance that will help you feel confident about your retirement future.

Be a Smart Investor

Stay up-to-date with industry-leading information and news delivered straight to your inbox.

Get our timely insights delivered to your inbox (Blog)

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Opal Wealth Advisors, LLC [“OWA]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from OWA. OWA is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the OWA’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.opalwealthadvisors.com. Please Remember: If you are a OWA client, please contact OWA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.