What Investors Need to Know About the Future of ESG Investing

By brittany | June 30, 2021ESG investing has exploded in recent years. It’s an investment approach that looks beyond prospective financial returns and is shaped by the investor’s unique values and moral compass. When choosing companies to invest in, the mindful investor weeds out organizations that don’t share these values. ESG investing is a form of socially conscious investing that focuses on:

- Environmental responsibility

- Social issues

- Governance (i.e. corporate governance)

The idea is to reap financial returns by investing in companies that are doing good in the world. With that said, there will likely be real challenges ahead for ESG investors. Here’s what you need to know to help you navigate socially responsible investing with both eyes open.

What Is ESG Investing?

ESG investing is a catch-all term that covers different types of conscious investing. Environmental sustainability is often a driving force that nudges investors to consider a company’s energy usage and overall impact on the climate. ESG investing also takes social awareness into account, popularizing companies that tout ethically sourced products, for example. The third arm of ESG investing is corporate governance, which often refers to an organization’s diversity and inclusion initiatives, as well as its efforts to prioritize equality and weed out discrimination.

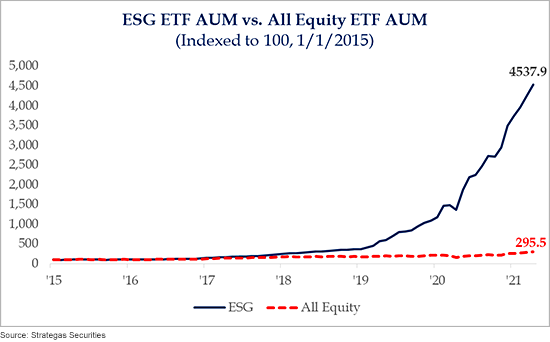

This kind of values-led investing has ballooned and performed well in recent years. ESG ETF assets under management have spiked significantly, especially since 2019.

But numbers like these don’t necessarily guarantee smooth sailing for ESG investors going forward. New challenges on the horizon could create unexpected hurdles.

What’s Next for ESG Investing?

While ESG investing has indeed boomed over the last few years, that’s due in large part to the fact that it screens out stocks in the Materials and Energy sectors—two notoriously low-performing sectors. Having this filter in place has only helped ESG performance. However, as the economy recovers and we see the possibility of inflation, Materials and Energy stocks may perform well over the next three to five years.

In fact, these two sectors are outperforming for the first time in a decade. Year-to-date, the Energy sector is up over 39%, with the Basic Materials sector right behind it at 20%. Meanwhile, the S&P 500 is up roughly 11.5% (5.4% for the NASDAQ).

The cost of ESG investing could be another challenge. Exchange-traded funds (ETFs), which encompass groups of securities, are linked to a market index, meaning they reflect index mutual funds. There are lots of ETFs that are centered on socially responsible companies. Let’s look at the iShares ESG Aware ETF, which is arguably the most popular ESG ETF. It actually has a 98% correlation with the S&P 500, so the products being sold are nearly identical to the broader index. So what’s the difference? The price is much higher — 15 basis points for the ESG ETF, compared to just 3 basis points for a regular index fund.

Of course, investors always have the option to buy individual stocks from companies that are aligned with their values. However, ESG investing isn’t unlike traditional investing. There’s always risk, and investment returns are never guaranteed. This is precisely why it’s so important to diversify your investment portfolio and spread out the risk.

What Investors Need to Know About the Future of ESG Investing

As ESG investing continues to evolve, it’s important to highlight that the metrics that define this type of investing aren’t very clear. Who’s to say what makes one investment more ethical or morally sound than another? While one investor may be drawn to a company that practices environmental sustainability, another might shy away from it if its corporate leadership lacks racial or gender diversity. In other words, the definition of socially responsible investing can be quite subjective and appears to be ever-changing.

When it comes to using your investment portfolio to support causes you care about, it’s really about building an individualized strategy that ticks off two important boxes—investing in companies that share your values and positioning yourself for the best potential financial returns in the long run. This includes accounting for traditionally low-performing sectors that are expected to do well in the next few years.

There are many nuances to consider, but a skilled financial advisor can help you create an investment portfolio that’s tailored to your unique values and financial goals. Contact an Opal advisor today to figure out an ESG investing plan that feels right to you.

Be a Smart Investor

Stay up-to-date with industry-leading information and news delivered straight to your inbox.

Get our timely insights delivered to your inbox (Blog)

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Opal Wealth Advisors, LLC [“OWA]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from OWA. OWA is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the OWA’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.opalwealthadvisors.com. Please Remember: If you are a OWA client, please contact OWA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.