12 Simple Year-End Tax Planning Tips to Consider Now

By Lee Korn | November 27, 2023Tax planning may not be top of mind this time of year, but giving it some thought can help maximize your long-term savings and boost your retirement nest egg. It isn’t something that needs to take a lot of time or effort. The first step is scheduling an end-of-year chat with your Opal advisor. Here are 12 simple year-end tax planning tips to discuss together.

1. Review Your Last Tax Return

Have there been any significant changes this year? Below are some life events that could impact your tax situation:

- Getting married or divorced

- Welcoming a child

- Buying a new primary residence, vacation home or investment property

- Experiencing a major liquidity event, such as receiving an inheritance or selling a business

- Owning foreign assets

- Starting a new business

- Beginning a new job

- Retiring

Discussing these things with your Opal advisor can help you prepare for next tax season and prevent unwanted surprises.

2. Look at Your Charitable Giving Plans

Now is the time to wrap up your charitable donations for the year, which may be tax-deductible. One option is to establish a donor advised fund to hold your family’s charitable dollars. The fund can be used to make grants to causes you want to support. If your 2023 income is on the higher end, consider bunching together several years’ worth of donations into this year. That will allow you to take a larger tax deduction. You can then spread your distributions out over many years.

If you’re 70½ or older, qualified charitable distributions can also provide significant benefits. Instead of taking required minimum distributions (RMDs), you can donate that amount directly to charity—and reduce your taxable income. This could keep you in a lower tax bracket and prevent certain tax deduction phase-outs. Opal’s Charitable Giving Tools Guide can provide other helpful tips.

3. Consider Tax Loss Harvesting or Gain Harvesting

If you have long-term holdings that have resulted in losses, you can sell those assets and replace them with similar ones. Those losses can be used to help offset capital gains. This is a strategy known as tax loss harvesting. Tax gain harvesting involves keeping an eye on your tax bracket and taxable income. The idea is to realize long-term capital gains during years that your income is lower.

4. Compare Municipal Bonds vs. Taxable Bonds

Use this time of year to review your government bond allocation. With Treasury bonds, which are issued by the federal government, you’ll have to pay federal income tax on investment gains, but state and local taxes are off the table. Municipal bonds, on the other hand, are exempt from federal taxes—and usually state taxes too. Having them in the mix can help you save money on taxes.

5. Revisit Your Asset Allocation Strategy

The end of the year is generally a good time to review your asset allocation. Due to normal market activity, it’s likely that your holdings have changed in value over the course of the year. Your financial advisor can help you rebalance your portfolio so that it reflects your desired allocation. The right allocation for you will depend on your financial goals and risk tolerance.

6. Use Roth Accounts to Your Advantage

This is possible even if you earn too much to contribute to a Roth IRA. Here are a few strategies:

- Open a traditional IRA, make after-tax contributions, and then transfer the balance to a Roth IRA. You’ll pay taxes on the appreciation of those contributions, but earnings in the Roth IRA will grow tax-free. You’ll also enjoy tax-free distributions in retirement.

- Make after-tax contributions to a 401(k), then convert your funds to a Roth IRA or Roth 401(k).

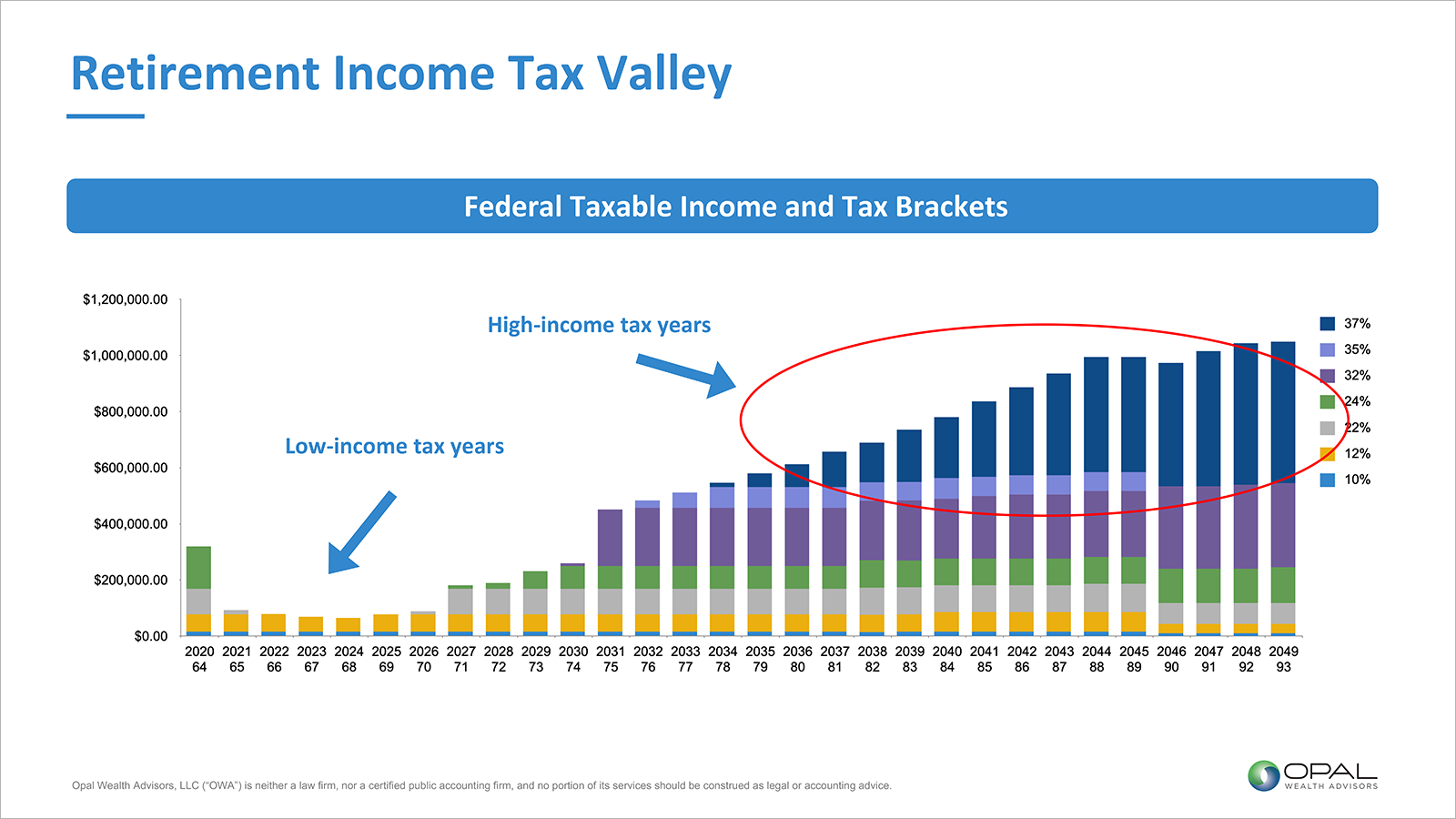

- Take advantage of income tax “valleys” to do a Roth conversion. If you have money in a traditional IRA or 401(k), you can convert it to a Roth IRA in years when your income is lower. Since you’ll pay taxes on the amount you convert, doing it at this time might prevent you from being pushed into the next tax bracket. For many, the right time is between age 65 and 70—after you retire but before you begin collecting Social Security or taking required minimum distributions (RMDs).

It’s important to note that the individual tax provisions of the Tax Cuts and Jobs Act will expire at the end of 2025. Tax rates are set to increase at that point, and only time will tell if elected officials intervene. To be on the safe side, you’ll want to get those Roth conversions in before rates go up for high earners. For more helpful tips, download our guide to 10 Ways to Reduce the Tax Bite on Your Retirement Income.

7. Review Your Employer Retirement Plan

Speaking of retirement accounts, check with your employer to see if there are any changes coming to your 401(k) plan. Also be sure that you’re contributing enough to secure an employer match. You can also use this time to increase your contributions. Contact your company benefits coordinator to set the ball in motion.

8. Meet Your RMD Obligations

If you’re 73 or older, you’ll need to take RMDs from tax-deferred retirement accounts. That includes 401(k)s, traditional IRAs and inherited Roth IRAs. The IRS uses a specific calculation to determine your RMD amount, and it’s important that you take it by the end of the year. Otherwise, you could face a 50% penalty on the amount not taken.

9. Consider Shifting Capital Gains to Children

Gifting appreciated stock to your children can be a win-win for both parties. If it’s an asset you’ve held for at least a year, you’ll avoid paying capital gains tax—and so will your child if their taxable income doesn’t exceed $44,625 in 2023. Another end-of-year financial task is making extra contributions to a child’s 529 savings plan.

10. Review Financial Planning Assumptions

Carve out some time before the new year to see if you’re on track for retirement. That involves reviewing your financial situation and retirement goals with your Opal advisor to ensure that you’re moving in the right direction. If not, you can take steps to course-correct as needed. You’ll also want to discuss your Social Security filing plan and overall retirement tax strategy. That can help your nest egg go further in retirement.

11. Review Estate Planning Documents

If you’ve had a major life change, you may need to update your estate planning documents. You can also talk out your values with your Opal advisor and make adjustments based on that conversation. For example, you may have decided to leave certain assets to your children or launch a charitable foundation as part of your legacy plan. At Opal Wealth Advisors, we help our clients button up these kind of details.

12. Look at Your Insurance Policies

You may decide to increase certain coverage types or to add (or increase) umbrella insurance. It’s also important to make sure that all your beneficiaries are current. If you have a permanent life insurance policy, that could also help provide retirement income when you’re no longer working.

Tax planning is no small thing, and this time of year is an optimal time to take stock of where you are. Opal Wealth Advisors is here to help. Schedule a conversation with us today to get started.

Sources: IRS, National Philanthropic Trust, Fidelity Investments, Charles Schwab, Experian, Merrill/Bank of America, CNBC, Windgate Wealth Management, Pacific Life Insurance Company, Congressional Budget Office.

Be a Smart Investor

Stay up-to-date with industry-leading information and news delivered straight to your inbox.

Get our timely insights delivered to your inbox (Blog)

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Opal Wealth Advisors, LLC [“OWA]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from OWA. OWA is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the OWA’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.opalwealthadvisors.com. Please Remember: If you are a OWA client, please contact OWA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.